Our Observation

US Markets for all intents and purposes have digested the recent postings announcement in early January. Buyers embraced the higher-than-expected reductions with open arms, yet many buyers remain cautious by not chasing the Major’s Spigots and filling their tanks with base oil to the brim. A sign of the times is being witnessed. Base Oil Demand in January was in general considered only firm while February thus far is experiencing global demand weakness. The usual buying spur that coincides with a dropping in base oil postings seem to be muted for a few obvious reasons and a few not so obvious.

Out of the gate, 2023 feels more like a NORMAL seasonal slowdown of the past. Buyers typically come off of an end of the year run, reduce inventories some for tax reasons while others use it to reduce seasonal product slates and clear the deck to ready for the Summer Seasonal Production, thereby shifting products in March and early April for summer product runs.

Since the onset of COVID we have not seen “normal” at least in the last 36 months. It appears that the market is attempting a retracing of the “old normal” buying patterns. Seasonal Winter Slow, Spring Launch, Summer readiness.

Majors held off on the usual Nov-Dec Base Oil discounting that coincides with winter weakening demand waiting till early January to do so. Yes, we are all happy, but incentives to fill tanks at year end of 2022 were basically muted due in part to the delay and what was clearly a slowdown in the markets in general. 2022 was a challenge in general with conflicting data and coupled with the 4th Quarter slow down buyers have entered 2023 being cautious on all purchase fronts. So, with the early January postings drop we did see some ILMA’s opt for inventory buildup. Yet most buyers are buying only what they need and prefer to work from the middle of the tank for now. In their minds, having a “wait and see” position is safer than taking a risk to GO BIG now and regret it later should the markets stall or drop more.

This makes sense but let’s not forget, (and how can we?), buyers are still grappling with the effects of Additive Supply issues resulting from fractured supply chains across the globe. That is not to say that these are the only issues. There is plenty to add to the plate for which ILMA producers have had to deal with in the past 36 months. Driver Shortages, Packaging Shortages, Grease Shortages, Hyper Inflated Product Cost, Weather induced Force Majeures, so on and so forth. Hence, they are simply a bit gun shy and hedging on the conservative side.

Market feedback suggests that Additive suppliers are improving but not near 100% capable thus far. Buyers for the most part are currently getting only what they need and not what they truly want, and this will likely work itself out over the course of 2023. Makes sense. Additives cost skyrocketed much like the Base Oil Arena from 2021 to 2022. For the most part the Group I, II base oil sector have given much of the increases back to the market’s while additive suppliers are still on the fence working through the supply issues, they have been dealing with for the past 2 years. Thus, buyers are simply being cautious until more data comes along to push them in either direction. This is understandable coming off the heels of 2022 with the rise and stall in base oil pricing and additive cost. In short, Additive Producers are a much more complex issue and likely buyers will address this in 2023 with laser focus going forward.

Meanwhile with January’s base oil postings announcements, the math nearly pencils out that Group I, II Producers have basically caught up in giving back what they took in the fall then increases from COVID forward with, 600N, Bright Stock and GIII 4Cst being the outlier in the herd.

Group III producers are more of a mixed bag of scenarios. Grp III 4 cSt material is still mostly tight in most regions, especially for the fully approved higher end products. Semi Approved GIII 4 cSt producers have found their place in the market in the past few years. Yet like all boats in a rising tide, so too have they followed the general markets on pricing and tightness of supply.

The tenacles are far reaching and the accelerated increase in global demand has made its mark in the GIII category. We all know the terms; Short, Balance & Long is a global phenomenon. In the very recent and short time span the GIII markets have seen conflicting data whereby Group III 3, 6 & 8cSt supply was either short, balance or long depending upon the month, the region, and from producer to producer. And were priced accordingly. Yet the 4cSt has thus far been united in its position globally due in part to continued and strong demand for higher end PCMO/HDDEO engine oil specifications. We look to 2023 as being a critical year for GIII 4cSt supply side activities. With fewer and bigger providers, we should see some interesting supply dynamics manifest themselves for sure.

Moving forward we anticipate the markets will be different going into 2023. And the cautiousness of buyers is certainly warranted. They simply don’t know what they don’t know, and do not want to get caught in the squat.

The begging question is: “what is headed our way and what will it look like and possibly when we will see it. How can a buyer prepare.”

Since we are a global business, it really does matter what happens elsewhere. Case in point, the EU and China, Crude Pricing & alternate ULSD profitability, are the big ones to watch near term.

This is where the crystal ball gets somewhat blurry, and speculation takes the front seat. One could easily point out and say that the markets are currently soft on certain base oil categories witnessed by the Arbitrages to and from across the globe. At the moment we see that US Group II Export pricing is telling us that Global demand is weak for this category while we have also seen falling GI Spot prices overseas as well. This is not a forever event. Markets rise and fall based on Global Ebb and Flow / Demand: Supply side dynamics.

China is in the early stages of pulling out of its self-imposed Zero COVID lockdown as well as coming out of the Chinese Lunar new year shut down from Jan 22 through Feb 9th while at the same time the EU is dealing with the ramifications of the Ukraine War. One is emerging back into the markets while the other is struggling to work through the energy crises and its implications from the Ukraine war. And let’s not forget that the Russians have recently announced a 500K Bbl Crude Oil Production Cut per day in the open markets. This is fertile ground for a completely different discussion at some point.

Ok now what? Many dynamic factors are working through the system that will likely impact base oil pricing and supply as well as other sides of the lubricant blenders. As noted above, China announced in January that they are pulling away from the Zero COVID lockdowns which have dampened their overall demand for base oils and cascading products not to mention their overall economy. Should this be true, we should expect a lag time of 60-120 days before we can see the effects and reentrance of China’s demand in the charts. April May timeframe? We will see soon enough. Having said this, China has the ability when running on all pistons to easily suck up any overhang of global base oil oversupply.

The EU is another issue all together. We have seen an overall slowdown in the EU economy that has translated to a slowdown in the demand for GI, GII and fewer cases of GIII base oils.

But not for long. They started earlier in the slowdown due in part to the forced energy cuts and realignment of supply culminating from Sanctions against Russian oil products. The sanctions HAVE finally kicked into full gear February 5th forward. This does not STOP the EU economy and California will not slide into the Ocean. We will merely see a shift and as such through the course of 2023 we should see a resurgence although weaker than normal of resupply into the EU on base oils as realignments are made moving forward. Food for thought, the softness in EU demand could easily be balanced out by China’s possible surging demand.

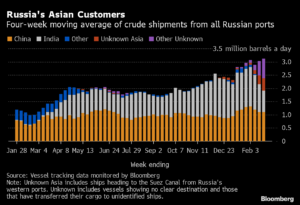

One interesting factor that we must add to the mix is the FULL Sanction of Russian Crude in the EU. The CAP at $60 a Bbl of Russian Crude will likely enjoy sales in China and India both of which will benefit from cheaper oil overall and can cascade into other downstream product arbitrages. Only time will tell, and we are watching closely going forward.

We continue to see a competing dynamic with Ultra Low Sulfur Diesel vs. other (IE Base Oil) Production pressure. Refiners in this current market can easily produce more ULSD garnering a premium to GP per gallon return and thus should base oils become too sloppy, they will simply shift more production to ULSD and less for base oil. A sloppy market problem solved. This is the balancing act for the Refiner. Do they hedge for Possible Base Oil Demand Increase or Decrease while opting for better margin return on ULSD? It is not a perfect game. But it is something that impacts our world. Follow DF#2 as it is a very telling gauge for up or down trends.

So, what do we see on US Soil? For now, we see Soft to some increased Demand going into early March. We see two Major Gulf Base Oil Refinery turnarounds remaining where one is currently in play for a 55-60 Day period and another for a short turn starting in mid-March. Both of which have an ample supply that will get them through the turns. Should all go well, both will be online going into April when the usual base oil demand pickup occurs. We should have a better idea as to what Base Oil Postings will do. “IF” the markets (domestic and global) remain soft and as the two refiners come back online, we will either see continued pressure to hold postings pricing or even pressure enough that may cause some discounting as an incentive for buyers to breakout of the “work from the middle of the tanks” philosophy. We understand that we do not live in a bubble. Should China re-emerge as we suspect in the coming months, it may be enough to counterbalance the effect of Sluggish demand for the GII Global Supply scenario. Remember, refiners do not go into a turnaround to come out and cut production. They come out swinging looking to gain more market share.

2023 will be no different than any other year. The outcomes will be based on Supply Side, Demand Side and Alternative Value Side Dynamics. One would argue that the last 3 years have taught us that nothing remains constant. That is the only constant thing to remember.

Should you wish to discuss in much more detail your base category needs, we would invite you to reach out and allow us the opportunity to share what and how we help our customers navigate the ever-changing base oil markets.

U.S. Refineries

Base Oil Exports

US’ December base oils exports slump

Exports fall to lowest in almost a decade

8 Feb, 2023; US base oils exports slid in December to the lowest in almost a decade, adding to a drop in global supply at a time of year when refiners typically struggle to clear surplus volumes. The fall in shipments coincided with a drop in Asia-Pacific base oils exports in December to their lowest in more than two years. The European market faced a sharp fall in imports from Russia throughout most of last year and a halt to such shipments from early February. The fall in global supply was unusual for the time of year. Surplus volumes at year-end typically give buyers the opportunity to start to build stocks ahead of the spring oil-change season. The volumes also help to create a supply buffer to cover for a typical drop in production during plant maintenance work in the first few months of the year. Global base oils prices fell late last year and early this year in a way that was similar to previous years. But the drop in base oils exports from the US and Asia-Pacific in December was different from previous years and curbed buyers’ opportunity to build stocks.

(Source: https://www.baseoilnews.com/americas/us-base-oils-exports-dec2022)

Refineries

U.S. oil refiners set for strong 4Q earnings as margins stay high

By Laura Sanicola Jan 23 (Reuters) – U.S. oil refiners are expected to report higher fourth quarter earnings thanks to strong demand and healthy margins from processing crude oil into motor fuels, said analysts. Profits last year from turning oil into gasoline, diesel and jet fuel hit multi-decades highs as plants ran full bore to meet rising travel and exports demand. Profits surged into the stratosphere for a sector that had been largely written off as the first victim of the energy transition.

Non U.S. Refineries

Sinopec Among China’s Oil Giants Seeking More Russian Imports

China’s state-owned oil refining giants are speeding up purchases of Russian crude, citing the allure of cheap cargoes from the OPEC+ producer as demand recovered after COVID Zero was ditched. China Petroleum & Chemical Corp., or Sinopec, as well as PetroChina Co. and CNOOC Ltd. have started and will continue to ramp up their procurement of Russian grades in the coming months, said people with knowledge of the matter, who asked not to be identified as the information is private. Shipments purchased include flagship Urals, which ships from Russia’s distant western ports, as well as ESPO, which loads from pacific terminals. Sinopec declined to comment, while PetroChina and CNOOC didn’t immediately respond to Bloomberg News queries.

(Source: https://www.ogv.energy/news-item/sinopec-among-china-s-oil-giants-seeking-more-russian-imports)

China’s State Refiners Buy More Russian Oil, Energy Aspects Says

- Demand from Chinese oil majors to lift flows from OPEC+ seller

- Imports may rise even more if nation replenishes stockpiles

Bloomberg News; February 9, 2023

China’s state-owned oil majors have stepped up Russian imports in a sign that Beijing is ready to give the go-ahead for more purchases of the country’s crude, according to industry consultants Energy Aspects. PetroChina Co. and CNOOC Ltd. recently resumed imports of waterborne Russian oil, with at least three supertankers of Urals-grade crude signaling China as a destination, EA analysts wrote in a note, without saying where they got the information. China Petroleum & Chemical Corp., or Sinopec, may also increase its intake of the flagship Urals in the coming months, the analysts said.

Russian oil refinery erupts in latest mystery fire at key energy installations

Ten fire brigades were sent to tackle the blaze, and there was a call for reinforcements amid a “difficult situation” at a giant Lukoil installation near Nizhny Novgorod, some 300 miles east of Moscow in Russia

Will Stewart; 7 Feb 2023; A huge oil refinery has gone up in flames in Russia with footage from the scene this morning showing black plumes of smoke billowing from the facility. The inferno at a giant Lukoil installation near Nizhny Novgorod, some 300 miles east of Moscow, is the latest mystery fire to hit key energy installations amid the war against Ukraine.

Footage showed large flames from a damaged gasoline pipe at the complex in Kstovsky district.

Ten fire brigades were sent to tackle the blaze, and there was a call for reinforcements amid a “difficult situation”, according to local reports. There were no initial reports of casualties. Russia has been hit by a succession of fires at strategic sites amid suspicions that some are sabotage in protest at Vladimir Putin. The Lukoil Nizhegorodnefteorgsintez facility is one of Russia’s largest oil refineries, with a capacity of 17 million tonnes per year.

(Source: https://www.mirror.co.uk/news/world-news/russian-oil-refinery-erupts-latest-29153284)

The Crude Side

Oil Prices Set For A Significant Weekly Gain As Russia Announces Production Cut

Irina Slav – Feb 10, 2023

- Oil prices spiked on Friday morning as Russia announced plans to cut its oil production by 500,000 bpd in March.

- Oil prices had been under pressure in the second half of the week as the Fed signaled it would continue with rate hikes and Chinese demand failed to impress.

- Oil prices are now on course for a 10% weekly gain, and the return of Chinese demand will only add to bullish sentiment

Oil prices spiked on Friday morning as Russia announced plans to cut its oil production by 500,000 bpd in March. The plans were a response, according to Deputy Prime Minister Alexander Novak, to western price caps. Crude oil prices were already set to end the week with an overall gain, although in the second half of the week the price climb began to fizzle out as the Fed signaled it would continue with rate hikes and Chinese demand had failed to impress. The announcement by Russia means oil prices are now set for a significant gain this week. West Texas Intermediate has climbed nearly 10% since the start of the week even though it had slipped below $78 per barrel in early Asian trade. On Thursday, both benchmarks closed with a decline as concern that oil infrastructure in Turkey may have been damaged by the devastating earthquakes was alleviated by the lack of any evidence of damage. Crude oil inventory reports from the United States also served to pressure crude oil prices lower this week. According to the Energy Information Administration, inventories of crude in the country rose for the fourth week in a row and are now above the five-year seasonal average. Expectations of stronger Chinese demand for crude continue to support oil prices: “We expect Chinese oil consumption to increase by around 1.0 million barrels a day this year, with strong growth emerging as early as late in Q1,” analysts from ANZ Bank said, as quoted by Reuters on Thursday. “Overall, this should push global demand up by 2.1 million barrels a day in 2023,” they added.

What drives crude oil prices: Overview

EIA assesses the various factors that may influence crude oil prices — physical market factors as well as those related to trading and financial markets. We describe the seven key factors that could influence oil markets and explore possible linkages between each factor and crude oil prices. We include regularly-updated graphs that depict aspects of those relationships.

Several graphs include projections from EIA’s Short-Term Energy Outlook. Graphs are updated with new data on a monthly, quarterly, and annual basis according to the schedule below. Analytical text will be updated as needed.

(Source: https://www.eia.gov/finance/markets/crudeoil/)

From The Streets

Oil Shippers Rake In Billions From Russian Oil Trade

By Tsvetana Paraskova – Feb 09, 2023

- Oil shipping firms and Asian refiners are raking in billions of U.S. dollars from transporting and refining Russian crude.

- Most of the shipping companies transporting Russian crude – without breaching the sanctions and price cap – are based in the United Arab Emirates, Greece, India, and China.

- While shipping firms and refiners are making “crazy good” money off trade in Russian crude, the Russian budget revenues are sinking with the low prices of Urals.

While Russia looks to contain the loss of oil revenues as the price of its flagship crude plummeted after Western sanctions took effect, oil shipping firms and Asian refiners are raking in billions of U.S. dollars from transporting and refining Russian crude.

To attract customers in China and India ahead of and after the EU embargo and the G7 price cap, Russian exporters have been offering $15-$20 per barrel discounts, and they are also paying $15-$20 per barrel to shipping companies to transport the crude to Asia, traders in Russian crude have told Reuters.

(Source: https://oilprice.com/Energy/Energy-General/Oil-Shippers-Rake-In-Billions-From-Russian-Oil-Trade.html)

U.S. Oil, Gas Production Set to Break Records in Spite of Obstacles

Alex Mills; February 2, 2023

Even though President Joe Biden’s regulatory agencies continue to throw road blocks in the path of American oil and gas producers, the industry continues to respond positively to global and domestic markets and it is on a path to set records in 2022 and 2023. U.S. oil production in November, the most current figures available, increased 5 percent over November 2021 from 1,790 million barrels of oil per day to 12,375, according to the U.S. Energy Information Administration (EIA).

(Source: https://oilmanmagazine.com/u-s-oil-gas-production-set-to-break-records-in-spite-of-obstacles/)

Chevron’s earliest predecessor, Pacific Coast Oil Co., was incorporated in 1879 in San Francisco. The first logo contained the company name against a backdrop of wooden derricks set among the Santa Susana Mountains that loomed over Pico Canyon. This was the site of the company’s Pico No. 4 field, California’s earliest commercial oil discovery.

The Early Years

1876-1911

The quest for black gold

Spurred by memories of the gold rush, hordes of prospectors descended on California in the 1860s, seeking another kind of bounty – black gold, or oil. Their early efforts were fruitless.

Undeterred, petroleum pioneers Demetrius Scofield and Frederick Taylor of the California Star Oil Works, a Chevron predecessor, took aim at Pico Canyon, a remote portion of the rugged Santa Susana Mountains. In September 1876, driller Alex Mentry succeeded in striking oil in Pico No. 4.

The first successful oil well in California, Pico No. 4 launched California as an oil-producing state and demonstrated the spirit of innovation, ingenuity, optimism and risk-taking that has marked the company ever since. Lacking the capital, it would need to seize marketing opportunities in this growing area, California Star was acquired by the Pacific Coast Oil Co. (PCO), which led to PCO’s new incorporation on September 10, 1879.

Within the next year, PCO built its first refinery at Point Alameda on San Francisco Bay; constructed a pipeline that linked Pico Canyon with the Southern Pacific’s train station at Elayon in Southern California; and undertook an extensive, largely successful drilling program.

In 1895, the company initiated its enduring marine history when it built California’s first steel tanker, the George Loomis, which could ship 6,500 barrels of crude between Ventura and San Francisco.

A new force enters the region

In 1878, Standard Oil Co. opened a three-person, second-story office in San Francisco. Despite its modest trappings, Standard possessed marketing acumen, outstanding products, an aggressive advertising philosophy and financial backing from its New York parent.

By 1885, it consolidated its Western interests under its subsidiary, the Standard Oil Co. (Iowa), which controlled distribution stations throughout the West Coast.

Lacking Standard Iowa’s marketing savvy and financial clout, PCO in 1900 agreed to be acquired by Standard Oil Co. (New Jersey), while retaining the name of Pacific Coast Oil Co.

Richmond’s colossal refinery

After buying 500 acres of rolling lands on the northeast shore of San Francisco Bay in 1901, the company completed the Richmond Refinery a year later. To feed this new colossus of West Coast refineries, it laid a pipeline from Richmond to the prolific new oil fields at Kern River and Coalinga.

A new entity is born

As the company grew, it changed structurally. In 1906, a consolidation between PCO and Standard Iowa created a new entity, Standard Oil Co. (California), finalizing an integration that had existed for six years.

The “new” company stepped up its marketing efforts, particularly in gasoline sales, which nearly doubled between 1906 and 1910, and lubricants, which were marketed under the Calumet, Diamond, Petrolite, Ruddy Harvester, Zerolene and Zone labels.

To meet the growing market for motor fuels, the company came up with a revolutionary new sales mechanism – the world’s first “service station,” started in Seattle by sales manager John McLean.

The first gusher

Until now, Standard had left the hunt for oil to others. In 1909, the company decided to gamble on its ability to find its own oil. After several initial failures, the drilling team had its first success on January 22, 1910, when a gusher flowed in at 1,500 barrels a day at the Midway-Sunset Field in Kern County, California.

Going it alone

The company’s expertise in searching for oil became increasingly important as a May 1911 Supreme Court decision separated Standard Oil Co. (California) from its parent company, Standard Oil Co. (New Jersey).

Before the end of 1911, Standard Oil Co. (California) added to its refining capacity with the completion of the El Segundo Refinery in Southern California; formed the California Natural Gas Co. to expand its search for natural gas in the San Joaquin Valley and beyond; and constructed a second pipeline linking Richmond and the Kern River Field.

More to come…

1912-1926

1927-1946

1947-1979

1980-2001

2002-2019

2020-present

SUGGESTED READING –

The supply chain crisis is coming to a head. Today, your favorite products are missing from store shelves, caught in supply chain limbo somewhere in the Pacific Ocean. But what does this supply chain disruption look like six months, or even three years, from now? While we hope that post-pandemic recovery will absolve these issues, the reality is that digital currency, meme stonks, and social media can’t solve the age-old problem of producing and moving physical goods across oceans and continents. According to Jim Rickards, consumer frustration is only the tip of a very large, menacing iceberg that threatens global economic collapse.

We’ve come a long way!

The Renkert Oil & Signal Fluid Solutions team would like to take this time to thank you for your business and thank you for allowing us to be an important part of you supply team.