OUR OBSERVATION

Dear Readers,

April has rolled in with no shortage of excitement in the base oil world. Between spring maintenance season kicking into high gear, ongoing logistical headaches, and shifting export activity that’s more strategic than surprising, the market’s had more than its fair share of moving parts. Buyers and sellers alike are adapting to a push-pull of tightening supply in some regions and cautious buying behavior in others. As always, we’re here to break it down and keep things digestible. In this issue, we explore what’s been stirring in the North American market and peek at how international trends are weaving into the bigger picture. Let’s get into it.

Market Overview

It’s been a whirlwind month for the base oil market. Across North America, a handful of planned and unplanned refinery outages sent ripples through the supply chain. Some Group I production units were already running lean before April, but the added strain from seasonal maintenance has made availability even more sporadic. Bright stock, in particular, remains hard to come by, especially with consistent demand from West Africa and Latin America putting extra pressure on export volumes.

Meanwhile, Group II markets are stuck in a bit of a contradiction. While there’s been some buying activity this month, it hasn’t been driven by rising demand. Instead, it’s been more of a defensive move—blenders and buyers are trying to get ahead of potential trade disruptions sparked by tariff uncertainty. Refiners, for their part, are balancing this cautious buying behavior with ongoing maintenance schedules and volatile crude costs.

The transportation and industrial sectors—big consumers of Group II—have remained fairly quiet, leading to some downward pressure on mid- and heavy-viscosity grades. A few refiners are offering discounts to move surplus volumes, though those running at reduced rates are keeping excess availability in check. Pricing has held mostly steady for now, but the market feels like it’s on the edge of a shift if crude or trade dynamics start to swing more dramatically.

Group III, on the other hand, hasn’t lived up to the usual tension this month. Despite some earlier concerns around turnarounds in Canada and the Middle East, supply has remained surprisingly comfortable. U.S. buyers are seeing steady imports—particularly from Qatar and South Korea—with volumes described as sufficient to meet demand.

That demand, however, hasn’t been overly robust. The automotive sector, a major end-user of Group III, is feeling the pinch from tariff uncertainty and softened manufacturing output. This has led to some spot availability, especially for unapproved material, and pricing has held mostly flat. A few discounts have surfaced for non-approved grades, while fully approved material is still moving but under less pressure than anticipated.

The logistics side of things hasn’t offered much relief either. Elevated freight rates and backlogs at Gulf Coast ports are making inland deliveries unpredictable. On top of that, uncertainty surrounding U.S. tariff developments is putting some buyers in a cautious mood. It’s safe to say that everyone’s watching every link in their supply chain a little more closely these days.

Looking ahead to May, market participants will be focused on when—and if—some breathing room might return. But for now, the name of the game is adaptability. Whether it’s stretching inventories, revising purchase timelines, or adjusting blend strategies, staying nimble remains key in a market full of moving targets.

RECENT HEADLINES

U.S. REFINERIES

Valero to shutter at least one of its California refineries

Valero has warned the government of California that it will take at least one of its two refineries within the state offline during first-half 2026, fulfilling earlier warnings by industry advocates that recently enacted state legislation governing refiners would lead to unintended consequences. Continue Reading Here

Chevron begins oil and gas production from Ballymore project off of Louisiana

Chevron on Monday morning announced it has started oil and natural gas production from its Ballymore project off the Louisiana coast.

The deepwater project is the latest in a series of projects begun by Chevron in the past year and is a step toward the company’s goal of producing 300,000 net barrels per day of oil from the Gulf by 2026. Continue Reading Here

Calumet Announces Closing of Sale of Assets Related to Industrial Portion of its Royal Purple® Business

INDIANAPOLIS, April 1, 2025 /PRNewswire/ — Calumet, Inc. (NASDAQ: CLMT) (the “Company,” “Calumet,” “we,” “our” or “us”) has successfully closed its previously announced sale of assets related to the industrial portion of its Royal Purple® business, for $110 million in cash to a wholly owned subsidiary of Lubrication Engineers, Inc., a portfolio company of Aurora Capital Partners.

The assets sold related to Royal Purple’s high performance synthetic industrial product line including industrial gear lubricants, bio-environmental lubricants, stationary natural gas engine oils, hydraulic lubricants, and compressor oils, along with an exclusive license of the brand for industrial applications. During the year ended December 31, 2024, the industrial portion of the Royal Purple® business generated approximately $29 million of total sales. Continue Reading Here

NON U.S. REFINERIES

Rosneft Hits Revenue Record as It Defies Global Headwinds

Rosneft Oil Company posted record-breaking revenue and tax contributions in 2024, outperforming several global energy majors despite a challenging macroeconomic backdrop and regulatory pressure.

According to the company’s IFRS-based results released this week, full-year revenue jumped 10.7% year-on-year to 10.1 trillion rubles. That pace of growth put Rosneft ahead of international peers such as Shell, Chevron, Exxon, Equinor, and Total in topline performance. Continue Reading Here

PetroChina reports record 2024 net income on higher production

BEIJING, March 30 (Reuters) – PetroChina (601857.SS) , Asia’s largest oil and gas producer, on Sunday said annual net profit rose 2% to a record high, as moderately higher production helped to offset lower oil prices.

Its net profit totalled 164.7 billion yuan ($22.68 billion) in 2024, versus 161.1 billion yuan in 2023, while revenue dipped 2.5% to 2,938.0 billion yuan, PetroChina said in a filing to the Shanghai Stock Exchange. Continue Reading Here

Oil giant BP is seen as a prime takeover target. Is a blockbuster mega-merger in the cards?

Oil giant BP has been thrust into the spotlight as a prime takeover candidate — but energy analysts question whether any of the likeliest suitors will rise to the occasion.

Britain’s beleaguered energy giant, which holds its annual general meeting on Thursday, has recently sought to resolve something of an identity crisis by launching a fundamental reset. Continue Reading Here

THE CRUDE SIDE

Oil Prices Down 2% as Markets Scramble for Clarity

Crude oil prices fell sharply on Monday, with Brent and West Texas Intermediate (WTI) futures declining nearly 3% as markets reacted to perceived progress in U.S.-Iran nuclear negotiations and mounting concerns over global demand.

Brent crude was trading down 2.2% at $66.59, and the U.S. crude benchmark, West Texas Intermediate (WTI), was down 1.92% at $63.44, unsure of how to weigh the impact of a fast-evolving tariff war theater against what analysts are interpreting as a positive progress towards shifting away from military threats. Continue Reading Here

Russian oil drives OPEC share in India’s imports to record low, data shows

NEW DELHI, April 22 (Reuters) – The share of OPEC oil in India’s imports fell to a record low in fiscal year 2024-25 as refiners continued to gorge on cheaper oil from Russia, the top oil supplier to New Delhi for the third straight year, data obtained from trade and industry sources showed.

India, the world’s third biggest oil importer and consumer, has been tapping Russian oil sold at a discount after Western nations imposed sanctions on Moscow over the Ukraine war. Continue Reading Here

U.S. Crude Oil Stockpiles Post Small Increase

U.S. crude oil inventories rose for a fourth consecutive week amid higher net imports, while refineries ramped up their capacity use, according to data released Wednesday by the U.S. Energy Information Administration.

Commercial crude oil stocks excluding the Strategic Petroleum Reserve increased by 244,000 barrels to 443.1 million barrels in the week ended April 18 and were about 5% below the five-year average for the time of year, the EIA said. Analysts surveyed by The Wall Street Journal had forecast a 600,000 barrel increase in crude stockpiles. Continue Reading Here

FUN FACTS – How Oil Helped Win WWII: The Birth of Synthetic Rubber

During World War II, oil didn’t just fuel tanks and planes—it also sparked a revolutionary breakthrough that helped turn the tide: synthetic rubber.

When Japan cut off the U.S. and its allies from the world’s primary sources of natural rubber in Southeast Asia, it created a crisis. Rubber was critical to the war effort—used in everything from tires and fuel hoses to gaskets, boots, and aircraft components. Faced with this shortage, the U.S. government turned to petrochemicals and oil-based innovation.

American scientists, supported by oil companies, developed synthetic rubber from petroleum byproducts, launching a full-scale national effort that produced over 800,000 tons annually by the war’s end. This achievement not only sustained the Allied military machine but also laid the foundation for a massive post-war plastics and materials industry.

Thanks to oil, the U.S. didn’t just stay in the fight—it helped create a legacy of innovation that still drives industrial production today.

SUGGESTED READING

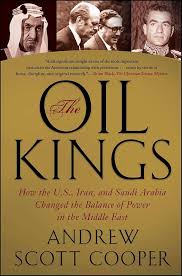

“The Oil Kings” by Andrew Scott Cooper

Uncover the high-stakes world of oil diplomacy with The Oil Kings by Andrew Scott Cooper. This compelling narrative reveals how U.S. alliances with Iran and Saudi Arabia in the 1970s reshaped global power dynamics. Drawing from newly declassified documents, Cooper provides an insider look at the geopolitical maneuvers that continue to influence international relations today.

WE’VE COME A LONG WAY!

Thank you for joining us in this edition of the Base Oil Newsletter. As we navigate the opportunities and challenges of 2025, we remain committed to providing you with valuable insights. Feel free to reach out to the Signal Fluid Solutions team for any inquiries or discussions.